Guide to Stock Market Data Scraping (Nasdaq, S&P 500, etc)

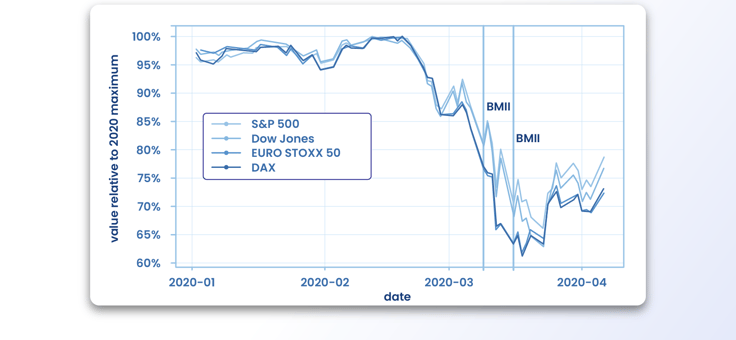

The stock market frequently confronts unexpected changes. However, the uncertainty of the stock market further escalated with the advent of Covid-19 and has made the stocks insanely cheaper than they used to be,, according to this report from VoXEU & CEPR. As a result, the people’s interest in the stock market accumulated to greater heights

The stock market frequently confronts unexpected changes. However, the uncertainty of the stock market further escalated with the advent of Covid-19 and has made the stocks insanely cheaper than they used to be,, according to this report from VoXEU & CEPR. As a result, the people’s interest in the stock market accumulated to greater heights than before in this pandemic period.

So with this article, we will talk about web scraping relevant to stock data. Unlike the general web scraping, the scraping for stock data attracts a small set of professionals. So if you fall into that niche, this article is for you. Dive in.

What is web scraping?

I hope all of you know what web scraping is. Nevertheless, I will dive into it with a brief introduction. Well, as you guessed it right, it’s all about extracting raw data by an organization from multiple sources on the web. The companies then use these data to derive useful information to execute decisions relevant to their business and many other tasks required by the business.

By scraping stock data, the company could gain valuable insights on the different trends prevailing in the stock market, real-time data – the data made available immediately as you acquire them, changes in prices, price predictions, and possibilities for investment.

If you implement the scraping of stock data correctly and accurately, it can yield some remarkable results to your company. For instance, when you scrape price data over a time period, you can understand whether the price will fall or rise in the near future. On the other hand, investors could discover the golden investing opportunities they want to invest in by extracting the investment-related data. However, despite these countless benefits, web scraping for stock data is not easy as it sounds.

Benefits of stock market scraping for your business

Any form of scraping results in immense benefits to your organization, particularly when implementing data-driven decisions for your business. In this section, you will discover some of the benefits of stock scraping to your organization.

One of the critical benefits of stock data scraping is identifying where investment opportunities lie. Therefore, investors need to make an in-depth analysis of the data to make accurate assessments to invest in a particular stock. You must be well aware that investing safely in the stock market is by no means an easier task.

This is due to the unpredictable nature of the stock market with some significant volatile variables. Each of such variables could influence the stock value. Therefore, the only way you could conclude that stock investments are safe is by analyzing all these volatile variables over time.

It would be best if you scraped significant quantities of data so analyzing them will give more accurate results. This indicates that you scrape these data using a scraping bot or software instead of manual scraping.

This scraping bot will scrape as much data as possible required for your scenario and then parse it. After that, you could analyze these data to make better data-driven decisions for your organization.

Factors to consider before scraping stock market data

We already mentioned that any form of scraping would have immense benefits for your organization. But jumping straight into scraping without a clear understanding of the outcomes you’re trying to achieve could result in you having a bunch of data sets that mean nothing. So let’s discuss some of the outcomes of data that you extract from scraping:

Gain a thorough understanding of your competitors

In order to gain a thorough understanding of your competitors, you need to understand your business and know your competitors whom you”ll be up against frequently. For instance, when you scrape the prices, it would assist you in determining the target market of your competitors.

There are numerous other factors to learn about your competitors before scraping data from their websites. For example, are you planning to price your products using a better pricing strategy than your competitors by scraping their prices? Or maybe you wish to identify the different patterns with product data to formulate better consumer buying decisions? The answers to these questions, along with ample others, can help you better understand your competitors.

How to make the most from the scraped data

After understanding your competitors, you need to determine how the scrape data will make sense to you. For example, suppose scraping exposes an unusual change in prices for a particular product in your area. In that case, you need to question it and analyze from the given dataset why it’s occurring. Some examples of the questions you need to ask are: Did the demand for the product escalated or declined? And are there any upcoming holidays that resulted in this change?

Most scraping tools export your data to Excel worksheets or CSV files in an easier-to-read format. So you need to understand them well before presenting them to your team.

Various sources for stock market data

The most prevalent way to scrape stock data is through APIs (Application Programming Interface) provided by the web. Until 2012 professionals used Google Finance to scrape stock data before it was deprecated.

Another popular option has been Yahoo Finance API which was also deprecated and revived on and off for years. Several private companies offer their APIs for scraping stock data. You can use them if you are not satisfied with the options provided in Yahoo Finance.

Limitations with stock market scraping

Having discussed the benefits of stock data scraping, you can not neglect the limitations of scraping. This is because web scraping is not straightforward as it may appear to be. Scraping stock data also involves accuracy and timely executions of various steps and processes to extract precise and actual data.

So most large-scale organizations implement their own tools to eliminate the destruction and to have a seamlessly smooth stock data scraping process. However, one of the prominent obstructions with stock data scraping is that your IP will most likely get blocked by the target website. Once your IP address gets blocked, the scraping bot or software would not have access to extract the data.

Although it is nearly impossible to avoid all the obstructions to scraping, using appropriate scraping tools will get the job done on most occasions. Also, most of the limitations can be avoided by coding the scrapper software distinctly and using proxies.

How to scrape stock market data

As discussed in the previous section, you need automated tools to carry out scraping stock market data. Using the right tools for stock market data scraping, investment companies and other business firms will increase their profits.

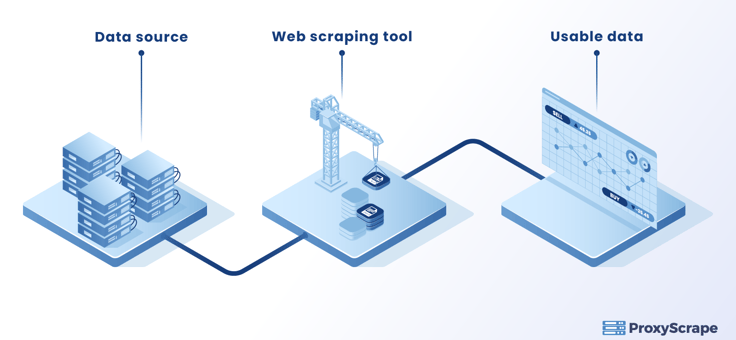

The first tool that you would come across is a scraper or data scraping tool. These tools are abundantly available for purchase.

On the other hand, companies looking for unique tools should invest in tools, resources, and indexes. This could be quite an expensive procedure depending on the amount of data that they intend to scrape.

The second entity that they would require is prerequisite data sources. In other words, they contain an index of web sources for stock market data that scrape your essential data. An automated data scraping tool will scrape all the raw stock market data from these sources and collect them.

Once the scraper tool collects the raw data through the index, they would need to be analyzed and polished for redundancies. You could carry out this process with a high-end data parsing tool or an in-house parsing tool which would not be difficult to implement.

After this process, there would be a lack of redundancies in your data, leaving only the data that can be usable. You can further obtain precise clean data when analyzed with software specific to the stock market.

However, it is possible to complete this entire process with a high-performance web scraping tool, a fever data analyst, and software specific to the stock market. Anyway, finally, these data are used to make educated decisions on investment.

Web scraping in real-time

Another essential aspect that needs to be discussed in this section is real-time scraping. Since the stock market data is volatile or with constant ups and downs moments, it is best to use a scraper that extracts data in real-time. When you have a real-time scraper, all the processes associated with web scraping would be carried out in a real-time manner, allowing the best and more accurate decisions to be made on data.

Real-time scrapers are far more expensive as opposed to slower scrapers. Still, they are excellent choices for investment firms and organizations that depend on precise data on the market, such as volatile stock data.

How proxies could help with scraping data for stock market

When it comes to using proxies for scraping stock data, it is absolutely essential regardless of whether you are using scraping software or carrying it out manually. This is primarily because most websites do not allow strangers to access their pricing data and openly scrape from them. Furthermore, it could slow down their websites and harm other functionalities.

When you repeatedly access the target website to scrape data, it would identify you from your IP address. The ultimate result is the target website imposing a block on you. This is where the proxies come in as your savior.

When you connect using proxies, they mask your IP address, and hence your identity will be anonymous to the target device. The ideal solution will be to use a pool of dedicated rotating proxies, as then your IP address would constantly alter. This contrasts with using a single proxy that would cause it to be blocked from the target website when you connect to it repeatedly.

When using a proxy, you must be cautious to avoid a proxy ban as well. You can confirm this by reading website terms as there is a fewer website that bans the use of proxies on their sites.

Conclusion

We hope now you have acquired the fundamentals of web scraping for stock data. Well, suppose you would like to explore ways to accomplish your business goals more instantly but methodically and accurately. In that case, your organization does not need to look any further than scraping the stock market data. With the correct tools with a combination of proxies, we hope you will achieve the desired results.